Strategic Wealth Building for Professionals

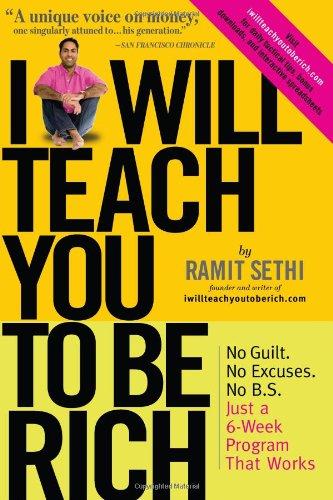

Ramit Sethi’s “I Will Teach You to Be Rich” provides a comprehensive guide to personal finance, focusing on practical strategies for wealth building. While the book is aimed at individuals, its principles are equally applicable to professionals seeking to enhance their financial acumen in a business context. The core themes revolve around automation, conscious spending, and strategic investment, all of which can be reframed to support professional development and business strategy.

Automation: Streamlining Financial Processes

One of the foundational concepts in Sethi’s book is the power of automation. By automating financial processes, individuals can reduce the cognitive load associated with managing money, allowing them to focus on strategic growth. In a professional setting, this translates to automating routine business processes to free up resources for innovation and strategic planning.

Automation can be applied to various aspects of business, from payroll and invoicing to customer relationship management. By leveraging technology, businesses can create efficient workflows that ensure consistency and accuracy, much like Sethi’s approach to personal finance. This aligns with modern business practices that emphasize agility and digital transformation, enabling organizations to adapt quickly to changing market conditions.

To put this into perspective, consider David Allen’s “Getting Things Done,” which emphasizes creating systems to manage tasks efficiently, thus reducing mental clutter and enhancing productivity. Similarly, in “The 4-Hour Workweek” by Tim Ferriss, automation is a key component in achieving lifestyle design and work-life balance. Both these works, like Sethi’s, underscore the importance of systematization to liberate time and mental energy for higher-level pursuits.

Conscious Spending: Prioritizing Investments

Sethi introduces the concept of conscious spending, which involves allocating resources to areas that truly matter while cutting back on less important expenses. In a business context, this principle can guide investment decisions, ensuring that capital is directed towards initiatives that align with the company’s strategic goals.

Professionals can apply this by conducting regular financial audits to identify areas of waste and reallocate funds to high-impact projects. This approach is reminiscent of the Agile methodology, where resources are continuously evaluated and adjusted to maximize value. By prioritizing investments, businesses can achieve sustainable growth and maintain a competitive edge.

Conscious spending can be likened to Stephen Covey’s “The 7 Habits of Highly Effective People,” where the emphasis is on distinguishing between what is urgent and what is important. Just as Covey advises focusing on important rather than urgent tasks to enhance personal effectiveness, Sethi’s conscious spending encourages businesses to focus financial resources where they will yield the most significant impact.

Strategic Investment: Building Long-Term Wealth

Investment is a key theme in “I Will Teach You to Be Rich,” with Sethi advocating for a diversified portfolio to build long-term wealth. For professionals, this means adopting a strategic approach to investment that balances risk and reward.

Incorporating insights from other financial thought leaders, such as Warren Buffett’s value investing or the modern portfolio theory, can enhance decision-making. By understanding market trends and leveraging data analytics, professionals can make informed investment choices that support business objectives.

For instance, in “The Intelligent Investor” by Benjamin Graham, the concept of value investing is extensively explored, focusing on long-term strategies rather than speculative gains. Sethi’s approach resonates with these principles by advocating for diversified, well-researched investments. Similarly, “A Random Walk Down Wall Street” by Burton Malkiel supports Sethi’s advice on diversification, suggesting that a broad market exposure reduces risk and enhances returns over time.

Financial Education: Empowering Teams

Sethi emphasizes the importance of financial literacy, a principle that can be extended to professional development. By fostering a culture of financial education within an organization, leaders can empower their teams to make informed decisions that contribute to the company’s success.

This involves providing training and resources that enhance employees’ financial skills, from budgeting and forecasting to investment analysis. By integrating financial education into professional development programs, businesses can cultivate a financially savvy workforce that drives strategic growth.

This concept parallels the ideas presented in “Drive” by Daniel H. Pink, which discusses the importance of autonomy and mastery in motivating employees. By equipping team members with financial knowledge, businesses not only foster a sense of mastery but also empower employees to take initiative and make strategic decisions that align with the organization’s objectives.

Negotiation and Persuasion: Enhancing Business Relationships

Negotiation is a crucial skill highlighted by Sethi, who provides practical techniques for securing favorable terms. In a business setting, effective negotiation can lead to better contracts, partnerships, and customer relationships.

Professionals can enhance their negotiation skills by studying frameworks such as the Harvard Negotiation Project or Chris Voss’s techniques in “Never Split the Difference.” By mastering the art of persuasion, businesses can strengthen their position in the market and build lasting relationships with stakeholders.

Consider “Getting to Yes” by Roger Fisher and William Ury, which introduces the principle of interest-based negotiation. This approach, focusing on mutual gains and collaboration, aligns with Sethi’s emphasis on understanding the underlying motivations in negotiations to achieve win-win outcomes.

Digital Transformation: Adapting to a Changing Landscape

Sethi’s principles can be reframed in the context of digital transformation, a critical consideration for modern businesses. By embracing technology and innovation, companies can streamline operations, enhance customer experiences, and drive growth.

Digital tools can facilitate automation, support data-driven decision-making, and enable remote collaboration, all of which align with Sethi’s approach to efficient financial management. By leveraging digital transformation, businesses can remain competitive in an increasingly digital world.

In “The Lean Startup” by Eric Ries, the emphasis on rapid iteration and customer feedback to drive product development can be seen as a form of digital transformation. Sethi’s principles similarly encourage businesses to adopt agile practices, ensuring they are responsive to market changes and customer needs in a digitized economy.

Final Reflection: A Holistic Approach to Professional Growth

“I Will Teach You to Be Rich” offers valuable insights that extend beyond personal finance, providing a framework for strategic business growth. By applying Sethi’s principles of automation, conscious spending, strategic investment, financial education, negotiation, and digital transformation, professionals can enhance their financial acumen and drive organizational success.

Embracing these strategies enables businesses to navigate the complexities of the modern economic landscape, ensuring long-term sustainability and prosperity. Through a holistic approach to professional development, organizations can unlock their full potential and achieve their strategic goals.

Moreover, integrating these financial principles with cross-domain insights from leadership, change management, and innovation can lead to a well-rounded strategic approach. As businesses face rapid changes and increasing competition, the ability to adapt and apply these concepts across various domains becomes crucial for sustainable success. Just as leaders in design and change management leverage continuous learning and adaptability, so too can financial strategy be dynamically applied to achieve holistic growth and resilience in the face of uncertainty.