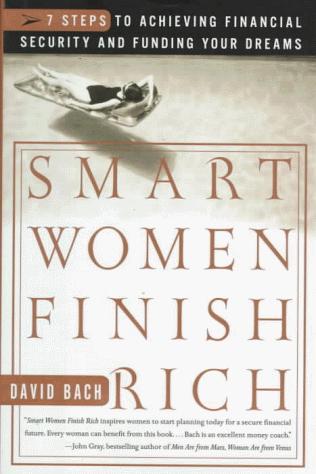

Empowering Financial Independence: Strategic Insights from “Smart Women Finish Rich”**

David Bach’s “Smart Women Finish Rich” is a seminal work that provides a comprehensive roadmap for women seeking to achieve financial independence and security. The book is a blend of motivational insights and practical strategies, designed to empower women to take control of their financial destinies. As we delve into the major themes of the book, we will explore strategic insights that professionals can apply in their own lives and careers.

1. The Foundation of Financial Empowerment

Bach begins by addressing the foundational mindset necessary for financial success. He emphasizes the importance of recognizing one’s financial potential and the power of taking proactive steps towards financial independence. This section parallels concepts from Carol Dweck’s “Mindset,” where the focus is on cultivating a growth mindset. Bach argues that financial empowerment begins with the belief that one can and should take control of their financial future.

Key Insight: Developing a proactive financial mindset is crucial. Professionals should regularly assess their financial goals and align them with their personal and career objectives. This alignment ensures that financial planning is not just a reactive process but a strategic component of one’s overall life plan.

2. Uncovering Hidden Financial Opportunities

Bach introduces the concept of the “Latte Factor,” a metaphor for identifying and redirecting small, unnecessary expenditures towards savings and investments. This idea resonates with the principles of lean management, where eliminating waste and optimizing resources are key to efficiency. The Latte Factor suggests that small, seemingly insignificant expenses can accumulate over time, significantly impacting long-term financial health.

Strategic Application: In a professional context, this translates to optimizing budget allocations and resource management. By identifying areas of waste, organizations and individuals can reallocate resources to more impactful initiatives, driving greater value and efficiency. For instance, a company might audit its operational expenses and find ways to cut excess spending, redirecting those funds into strategic growth areas.

3. Strategic Financial Planning

A significant portion of the book is dedicated to the mechanics of financial planning. Bach outlines a strategic framework that includes setting clear financial goals, creating a budget, and investing wisely. He draws parallels to strategic business planning, where setting objectives and aligning resources are fundamental. This strategic financial planning is akin to Stephen Covey’s “The 7 Habits of Highly Effective People,” where prioritization and proactive planning are emphasized.

Professional Framework: Professionals should approach financial planning with the same rigor as strategic business planning. This involves setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals, regularly reviewing financial plans, and adjusting strategies as needed to stay on track. For example, a young professional might set a goal to save a specific amount for a down payment on a house within five years, regularly reviewing their savings plan to ensure they are on target.

4. The Power of Investment

Investment is a central theme in Bach’s work, where he demystifies the process and encourages women to take charge of their investment portfolios. He discusses various investment vehicles and the importance of diversification, echoing the principles found in modern portfolio theory. This approach is similar to that advocated by Benjamin Graham in “The Intelligent Investor,” which emphasizes the importance of a sound investment strategy and the role of diversification in mitigating risk.

Investment Strategy for Professionals: Just as businesses diversify their product lines and markets to mitigate risk, individuals should diversify their investment portfolios. Professionals should educate themselves on different investment options and consider factors such as risk tolerance, time horizon, and financial goals when making investment decisions. For instance, a professional might balance their portfolio with a mix of stocks, bonds, and real estate to spread risk effectively.

5. Leveraging Technology for Financial Growth

In today’s digital age, technology plays a crucial role in financial management. Bach highlights the importance of utilizing digital tools for budgeting, investment, and financial tracking. This aligns with the broader trend of digital transformation, where technology is leveraged to enhance efficiency and decision-making. The use of technology in personal finance can be compared to the business world’s embrace of big data and analytics, as discussed in Thomas Davenport’s “Competing on Analytics.”

Digital Transformation in Personal Finance: Professionals should embrace digital financial tools and platforms to automate and optimize their financial management. This includes using budgeting apps, robo-advisors for investment, and online resources for financial education. By integrating technology into financial planning, individuals can make more informed decisions and achieve greater financial control. For example, using a comprehensive financial app can help track expenses, set budgets, and monitor investments in real time.

6. Building a Legacy of Wealth

Bach concludes with the idea of building a financial legacy, emphasizing the importance of long-term planning and wealth transfer. This concept is akin to strategic succession planning in organizations, where the focus is on ensuring continuity and sustainability. Building a financial legacy involves not only accumulating wealth but also planning for its eventual transfer to future generations.

Legacy Planning for Professionals: Professionals should consider their long-term financial legacy and how they can impact future generations. This involves estate planning, understanding tax implications, and setting up trusts or charitable contributions. By planning for the future, individuals can ensure that their financial success benefits not only themselves but also their families and communities. A practical example might be setting up a family trust that supports educational opportunities for descendants.

7. Core Frameworks and Concepts

Bach’s book introduces several frameworks and concepts that are crucial for financial planning and empowerment. One of the core frameworks is the “Finish Rich” system, which is designed to guide readers through a step-by-step process of achieving financial independence. This system includes:

-

Values-Based Financial Planning: Understanding your core values and aligning your financial goals with these values. This approach is reflective of Simon Sinek’s “Start with Why,” which emphasizes the importance of purpose in guiding decisions.

- Example: A professional who values education may prioritize saving for their children’s college fund as a primary financial goal.

-

The Latte Factor: Identifying small, everyday expenditures that can be redirected towards savings and investments.

- Example: Skipping a daily coffee shop purchase in favor of brewing coffee at home, redirecting the savings into a retirement account.

-

Pay Yourself First: Setting aside a portion of income for savings before paying bills and expenses. This principle is also found in George S. Clason’s “The Richest Man in Babylon,” where the importance of saving is a recurring theme.

- Example: Automatically transferring 10% of each paycheck into a savings account before using the funds for other expenses.

-

The Three Basket System: Dividing savings into three categories: security, retirement, and dreams.

- Example: Allocating savings into an emergency fund (security), a retirement account (retirement), and a vacation fund (dreams).

-

Automatic Millionaire: Automating savings and investments to build wealth over time. This concept aligns with the principles of automation in business, where processes are streamlined for efficiency.

- Example: Setting up automatic contributions to a 401(k) plan or an IRA to ensure consistent savings.

Each of these frameworks is designed to empower individuals to take control of their financial futures by making informed, strategic decisions. By applying these principles, readers can develop a comprehensive financial plan that aligns with their values and goals.

Final Reflection

“Smart Women Finish Rich” serves as both a practical guide and an inspirational manifesto for financial empowerment. By synthesizing Bach’s insights into strategic frameworks, professionals can apply these lessons to both their personal and professional lives, achieving financial empowerment and security. The book’s core message is one of empowerment through education, strategic planning, and proactive management.

In synthesizing Bach’s principles with insights from other prominent works, such as “The Intelligent Investor” and “The Richest Man in Babylon,” we see a common thread of sound financial principles underscored by disciplined planning and execution. Whether it’s through the strategic allocation of resources, the rigorous application of investment principles, or the leveraging of technology, the path to financial independence is paved with informed decisions and proactive management.

Moreover, the lessons in “Smart Women Finish Rich” extend beyond personal finance into domains like leadership, design, and change management. Just as financial planning requires setting goals, assessing risks, and making informed decisions, leadership demands vision, adaptability, and strategic thinking. In design, the principles of efficiency and resource optimization echo the need for thoughtful financial planning.

Ultimately, the book challenges readers to not just envision their financial futures but to actively shape them. By embracing these principles, individuals can navigate the complexities of the financial landscape and build a future of financial independence and success. Bach’s work encourages a shift in mindset that extends beyond finance—inviting readers to consider how strategic planning and empowerment can transform all areas of life.