Strategic Financial Transformation: Insights from “The Total Money Makeover”

Introduction to Financial Empowerment

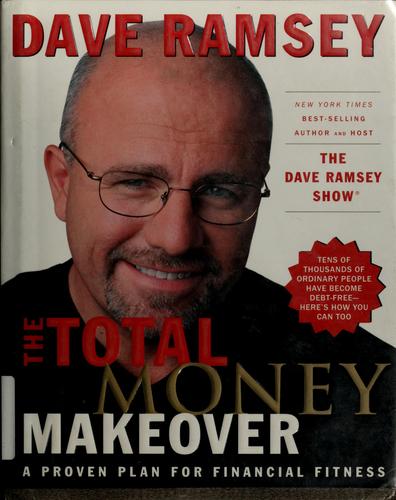

Dave Ramsey’s “The Total Money Makeover” is a seminal work in personal finance, offering readers an actionable blueprint for financial transformation. Though primarily targeted at individuals, the book’s principles hold significant value for professionals and organizations seeking to enhance their strategic endeavors. By exploring Ramsey’s insights through a professional lens, we can distill valuable lessons applicable to business strategy, leadership, and digital transformation. Comparing Ramsey’s work with other influential books such as “Rich Dad Poor Dad” by Robert Kiyosaki and “Your Money or Your Life” by Vicki Robin and Joe Dominguez, we can further explore the multifaceted approaches to financial empowerment.

Building a Solid Financial Foundation

The Power of Financial Discipline

At the heart of Ramsey’s philosophy lies the principle of financial discipline, which is vital for both individuals and organizations. This concept mirrors operational discipline in successful businesses. Just as individuals must avoid debt and manage expenses judiciously, organizations must maintain fiscal prudence to ensure sustainability. Kiyosaki’s “Rich Dad Poor Dad” emphasizes the importance of financial education and investments, which aligns with Ramsey’s advocacy for disciplined financial management. In the professional realm, financial discipline translates into making strategic investments, optimizing operational costs, and ensuring financial resources align with long-term objectives. For example, a company that rigorously audits its expenses and eliminates inefficiencies can reinvest those savings into innovation and growth, much like an individual who pays off debt to free up income for investing.

Emergency Funds: A Buffer for Uncertainty

Ramsey emphasizes the importance of an emergency fund as a financial safety net—a principle that extends to business through contingency planning and risk management. In an era marked by rapid technological change and market volatility, organizations need robust strategies to navigate unforeseen disruptions. This approach is echoed in “Your Money or Your Life,” which underscores the significance of financial independence and security. Companies that build financial reserves and flexible operational strategies can better withstand economic downturns and capitalize on emerging opportunities. Consider a tech startup that maintains a reserve fund to weather unexpected market shifts, allowing it to pivot quickly and seize new market opportunities.

Strategic Debt Management

Eliminating Debt: A Path to Financial Freedom

Ramsey’s advocacy for the aggressive elimination of debt can be extended to corporate finance, where high levels of debt can stifle innovation and adaptability. By prioritizing debt reduction, companies can release resources for strategic initiatives and foster a culture of financial agility. This approach aligns with lean operations and agile methodologies prevalent in modern business practices. For instance, a retail chain that aggressively pays down its debts can allocate more capital towards customer experience enhancements and digital transformation efforts.

Leveraging Debt Wisely

While Ramsey advises against personal debt, businesses often need to leverage debt strategically for growth. Differentiating between good and bad debt is crucial—good debt, such as investments in technology or infrastructure, can drive long-term value creation. In contrast, excessive or mismanaged debt can hinder strategic objectives. Leaders must assess the risk-reward balance and ensure that debt aligns with the organization’s vision and goals. This nuanced view of debt is also reflected in Kiyosaki’s work, where leveraging debt for asset acquisition is a key theme. For example, a construction firm might take on debt to invest in new machinery that significantly increases operational capacity and project turnaround times.

Investing in Growth and Innovation

The Importance of Smart Investments

Investment is a recurring theme in Ramsey’s work, highlighting the need for thoughtful and strategic resource allocation. This principle translates into investing in talent development, technology, and innovation for professionals. Organizations that prioritize continuous learning and embrace digital transformation are better positioned to thrive in a competitive landscape. This is akin to the philosophy in “Rich Dad Poor Dad,” where investing in assets that generate income is emphasized. By fostering a culture of innovation, businesses can drive sustainable growth and maintain a competitive edge. Consider a software company that invests heavily in R&D to stay ahead of industry trends and develop cutting-edge solutions.

Aligning Investments with Strategic Goals

Ramsey’s principles underscore the importance of aligning investments with long-term goals. Similarly, organizations must ensure that their investment strategies support their overarching mission and vision. This requires a clear understanding of market dynamics, customer needs, and technological trends. By aligning investments with strategic priorities, businesses can optimize their impact and drive meaningful outcomes. For example, a healthcare organization investing in telemedicine technology aligns its resources with the goal of expanding access to care, meeting both strategic objectives and patient needs.

Financial Leadership and Organizational Culture

Cultivating a Culture of Financial Responsibility

Ramsey’s approach emphasizes personal accountability and financial responsibility, which can be translated into a corporate context as fostering a culture of accountability and transparency. Leaders play a crucial role in setting the tone for financial discipline and ethical decision-making. By promoting a culture of financial responsibility, organizations can build trust with stakeholders and enhance their reputation. This idea parallels themes in “Your Money or Your Life,” where the alignment of values and financial choices is central. A corporation that encourages open discussions about financial performance and engages employees in budgetary decisions can create a sense of shared responsibility and commitment to financial health.

Leadership in Times of Change

Effective leadership is essential during periods of transformation. Ramsey’s insights into personal leadership can be applied to organizational change management. Leaders must communicate a clear vision, inspire confidence, and guide their teams through uncertainty. By embracing change and fostering resilience, leaders can drive successful transformations and position their organizations for long-term success. This is reflected in Kiyosaki’s narrative, where entrepreneurial spirit and adaptability are key to overcoming financial challenges. A manufacturing company that successfully transitions to a more sustainable business model exemplifies leadership’s role in navigating and implementing change.

Embracing Digital Transformation

The Intersection of Finance and Technology

In today’s digital age, the intersection of finance and technology presents new opportunities and challenges. Ramsey’s principles can be adapted to guide digital transformation initiatives. Organizations must leverage technology to enhance financial processes, improve decision-making, and deliver value to customers. By integrating digital tools and analytics, businesses can gain insights into financial performance and drive strategic growth. For instance, a financial services firm might implement AI-driven analytics to better understand customer behavior and tailor its offerings accordingly.

Agility and Adaptability in the Digital Era

The principles of agility and adaptability are central to both Ramsey’s philosophy and modern business practices. Organizations must be agile in their approach to finance, operations, and strategy. This requires a willingness to embrace change, experiment with new ideas, and iterate quickly. By adopting agile methodologies, businesses can respond to market shifts and capitalize on emerging opportunities. A technology startup that continuously iterates on its product offerings based on user feedback and market trends embodies this agile approach.

Final Reflection

Dave Ramsey’s “The Total Money Makeover” provides a robust framework for financial management that extends beyond personal finance to offer strategic insights for businesses. By integrating Ramsey’s principles with the strategic insights from books like “Rich Dad Poor Dad” and “Your Money or Your Life,” organizations can enhance their strategic capabilities, foster a culture of financial responsibility, and drive sustainable growth. As businesses navigate the complexities of the modern economy, embracing these strategic insights can lead to transformative success. The synthesis of personal financial discipline with corporate strategy can not only improve financial health but also enable organizations to become more resilient, innovative, and adaptive in an ever-evolving landscape. Whether through prudent debt management, strategic investments, or embracing digital transformation, the principles outlined by Ramsey and echoed in other influential works offer a comprehensive roadmap for achieving financial and organizational excellence across domains.